RESOURCES

Cases & Pleadings

CONTENTS

Four More Years?

War on Poverty

Yvanova

Soros Dumps JPM

Justices Rigged?

$13 Billion

Fabrice Scapegoat

Broken System

Hide the Ball

Corruption

Secrets & Lies

Kill the Lawyers

Haunting Obama

Bankers Unrepent

Mark Stopa

Geithner

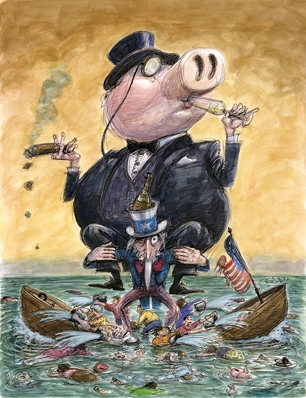

Sinking Sam

Big Chase

MERS Madness

Rachael Maddow

Wisconsin Fraud

Out of Whack

Credit Cards

Wrap-up 2011

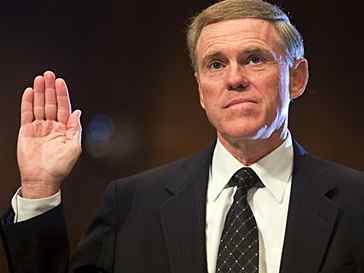

Killinger settlement

FHFA v Chase

SEC Fraud

Disaster

Wall St. Journal

Levin Report

Consent Orders

National Debt

Beaucoups Bucks

Lawyer Trail

Gaddafi

Killinger sued

Homewreckers

Ten Grand

Killing 'er

Jail Bait

Crime Pays

David Stern

The Big Boom

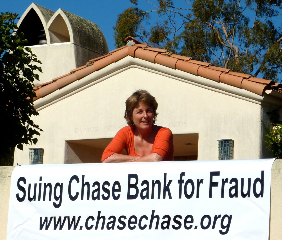

Chase Fraud

Ponzi Scheme

Beat Goes On

Housing Limbo

Feeling the Heat

Morgan Stanley

Dylan Ratigan

Losing Face

Class Actions

Banksters

Two Cities

How the feds failed

Ohio eviction

What's on Second

Yitzchak

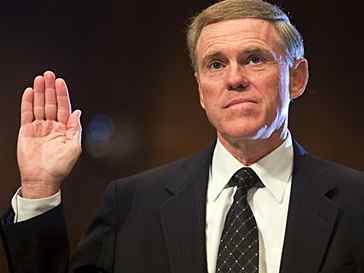

Blankfein

Dick Fuld

Bill Black 2

Gunsmoke

Crash Bank

Santa Barbara

Underwater

American Dream

Killinger

The Stress

The Sack

Geithner 2

WWIII

Find lawyer

Bankruptcy

Tim Miller

Downbeat

Hard Times

Auctioneer

Attitude

Deal/Steal

Dust to Dust

Geithner 1

Hank Paulson

Bill Black 1

COLUMNS

Margaret Carswell

- King Solomon's

Dilemma

- Deadbeat

Homeowner

- Cut to the Chase

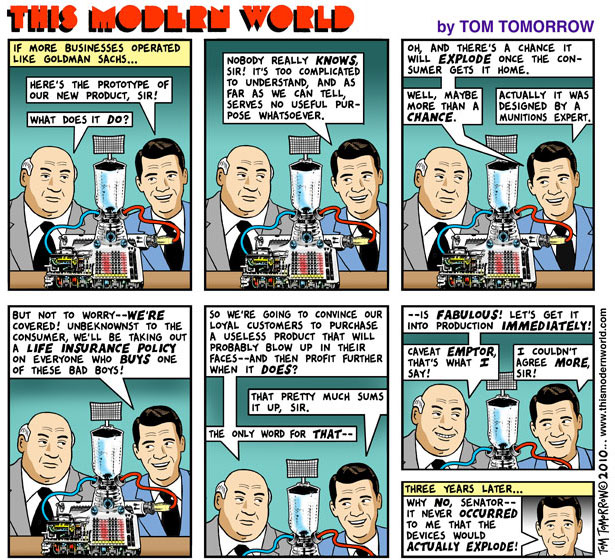

Tom Tomorrow

- Modern World

Barbara Caldwell

- Stress Of It All

ARTICLES

Mortgage Defense and the Law of Restitution

by Richard F. Kessler, esq.

4/16/2012

- - -

Will Wall Street Ever Face Justice?

by Phil Angelides

New York Times 3/1/2012

- - -

The Ibanez Time Bomb

by Elizabeth Renuart

Albany Law School

Rev. 2/22/2012

- - -

Homeowners' Rebellion

by Ellen Brown

- - -

Underwater and Not Walking Away: Shame, Fear, and Social Management of a Housing Crisis

by Brent T. White

- - -

Where's The Note, Who's The Holder by Hon. Samuel L. Bufford, Glen Ayer

- - -

The Great Collapse

by Kurt Eggert Connecticut Law Review

- - -

Subprime Meltdown

by James R. Barth, Tong Li, et al., Milken Institute

- - -

HAMP=Foreclosure so HAMP is a fraud

by Patrick Pulatie

- - -

The Dream Deferred

by Thomas Brom, California Lawyer

Legal Notices

Send us an email

|

Chase, Wells Fargo, US Bancorp still out of compliance

They still fail to meet 2011 servicing guidelines in June 2015

Four years after pledging to clean up wide-ranging foreclosure abuses, Wells Fargo, JPMorgan Chase, US Bancorp and three other banks still aren’t complying with consent orders imposed by a federal regulator, reported the Los Angeles Times (June 17, 2015). As a result, the Office of the Comptroller of the Currency has restricted mortgage servicing operations at Wells Fargo, Chase, U.S. Bancorp, Santander Bank, EverBank Financial Corp. and HSBC Holdings.

Banking regulators obtained the consent orders in 2011 in response to scandals involving the robo-signing of foreclosure documents by token officials without knowledge of the facts, lost paperwork, illegal fees, and other legal shortcuts that became common after the mortgage meltdown.

Welcome to the War on Poverty

From 2009 to 2012, the real incomes of the top one percent of American families rose 31 percent, while the real incomes of the bottom 99 percent barely budged (up less than half a percentage point).

Robert D. Putnam, Our Kids: The American Dream in Crisis (Mar 10, 2015)

The United States has the highest poverty rate, the greatest income inequality, and the greatest wealth inequality of any major developed economy in the world.

Edward Kleinbard, We Are Better Than This: How the Government Should Spend Our Money (2014)

If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered... I believe that banking institutions are more dangerous to our liberties than standing armies... The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.

Thomas Jefferson — The Debate Over The Recharter Of The Bank Bill (1809)

Yvanova v. New Century Mortgage — Cal. Supreme Court

62 Cal.4th 919 (Feb. 18, 2016)

In a watershed decision, the California Supreme Court decided that homeowners have a right to challenge the authority of a foreclosing entity to sell the house - after the foreclosure sale. Then the court remanded other cases to the Court of Appeals to wrestle with pre-foreclosure issues.

California Attorney General Kamala Harris filed an amicus brief in support of homeowners that concluded, "The Court should hold that homeowners may bring a wrongful foreclosure action on the basis that the party foreclosing on them lacks the power to foreclose because they do not own the debt, either due to an allegedly void assignment or for any other legally cognizable reason."

See the Yvanova Supreme Court decision and briefs in Cases & Pleadings

Two-thirds Who Lost Homes to Foreclosure Won't Return

-National Assn. of Realtors, April 17, 2015

Less than one-third of families who lost their homes to foreclosure or other distress events in the past decade are likely to become homeowners again, according to an analysis by the National Association of Realtors. More than 9.3 million homeowners went through a foreclosure, surrendered their home to a lender or sold their home via a distress sale between 2006 and 2014.

Fasten your Seatbelts, Bankabillies

George Soros Dumps All Shares of Chase, BofA and Citibank

George Soros sold his stakes in banks and went for tech and gold mines in the first quarter of 2014, according to a filing with the Securities and Exchange Commission. Soros sold his holdings in Citigroup, Chase, and Bank of America in 2014. Soros said at a Columbia University conference in 2009 that the world financial system had effectively disintegrated, and that there was no prospect of a near-term resolution to the crisis. “We witnessed the collapse of the financial system. It was placed on life support, and it’s still on life support. There’s no sign that we are anywhere near a bottom.” (Reuters)

Are Foreclosure Cases Rigged?

Many judges do not disclose financial ties to banks

The East Bay Express reported on May 13, 2014, that Justice Elizabeth Grimes, Second Appellate District Court of Appeal (Los Angeles), has voted in favor of Bank of America against homeowners in foreclosures cases even though she owns between $100,000 and $1 million worth of stock in Bank of America, according to public records maintained by the state Fair Political Practices Commission.

The Cal. Code of Judicial Ethics Canon 3E(3)(b) requires that judges disqualify themselves from any case in which they own stock or bonds issued by a party with a fair market value exceeding $1,500 — if the outcome of the proceeding could substantially affect the value of the judge’s bond. Grimes also owns between $100,000 and $1 million of stock in Wells Fargo and US Bank, and between $10,000 and $100,000 in Citibank, giving her potentially a multimillion-dollar stake in the profitability of the mortgage lending industry.

In 2012, the Second Appellate District (Ventura) ruled in favor of Bank of America in a wrongful foreclosure case brought by Daniel and Yvette Shuster. One of the justices in that the case, Presiding Justice Arthur Gilbert, held stock in four different financial companies that originate or service home mortgage loans, including shares worth as much as $10,000 in Bank of America and shares between $10,000 and $100,000 in JPMorgan Chase. Gilbert ruled in favor of Chase in a foreclosure case filed by Susan Lange that was argued in December 2012, and wrote an unpublished opinion in favor of Chase in another foreclosure matter decided in April 2011. Justice Gilbert disposed of his shares in Chase in May 2014 .

Forty-two of California's 105 appellate court justices (40%) own significant amounts of stock in at least one financial company. Attorney Patricia Rodriguez said the fact that so many judges have significant financial investments in the banking and mortgage industry means that they're inclined to rule against homeowners because a string of decisions against the banks could reduce the profitability of the entire sector. "They don't want to be the judge that allows forty million mortgages to go back to the borrowers," Rodriguez continued. "They don't want to possibly set a precedent." A series of cases decided in favor of homeowners against the banks could establish a precedent that would make it easier for borrowers to win lawsuits against their banks. Banks losing more often in court could have sweeping impacts on their profitability in California. (East Bay Express).

Chase settles with U.S. for $13 Billion

$4 billion goes to homeowners

Los Angeles Times - Nov. 20, 2013

JPMorgan Chase agreed to a $13-billion settlement with the government over selling shoddy mortgage investments, ending a legal battle that signals a tougher stance against Wall Street wrongdoing. The nation's largest bank admitted to knowingly peddling the toxic securities that helped lead to the housing bubble and the worst financial meltdown since the Great Depression.

California, slammed by 1 million foreclosures during the mortgage meltdown, will be a major beneficiary of the deal. The agreement includes $4 billion to help homeowners across the nation who were foreclosed on or who are struggling with their loans.

Sen. Bernie Sanders (I-Vt.) said he was pleased officials were taking action.

"What the American people understand is that we continue to be in the midst of a terrible, terrible economic downturn because of the greed and recklessness and illegal behavior of Wall Street,” Sanders said. “And I think people want justice to be done."

It was unclear Tuesday how the $4-billion relief program would be apportioned to struggling homeowners. Chase said it would distribute the assistance over the next four years. Half of the program will go toward writing down the balance of mortgages and waiving certain payments on home loans. Most of that would be achieved through outright forgiveness of first-mortgage debt.

Investors in Chase appeared to be relieved the bank was able to arrive at the the largest settlement made by any single American company in history. The bank's shares rose 41 cents, or 0.7%, to $56.15 on Tuesday, while major U.S. stock indexes edged lower. So apparently Wall St. thinks the Biggest Bank got off light.

Fabrice Tourre Takes the Fall

Little guys bounce higher than CEOs

New York Times - Aug 2, 2013

A federal jury found the trader, Fabrice Tourre, liable on six counts of civil securities fraud after a three-week trial in Lower Manhattan. Five years after Wall Street risk-taking nearly toppled the economy, the S.E.C. has taken only a handful of employees to court in connection with the crisis; most cases have been settled. The agency has not leveled fraud charges against one top executive at a big bank.

Some critics have questioned why the agency chose to make Mr. Tourre — a midlevel employee who was stationed in the bowels of Goldman’s mortgage machine — the face of the crisis. Rather than aim at a high-flying executive, the agency pursued someone barely known on Wall Street.

On September 30, his lawyers filed a motion for a new trial in federal court. Meanwhile, Fab is studying for a doctorate in economics at the University of Chicago, where Barack Obama was a law professor for 12 years.

A Broken System

Douglas Gillies

The law of contract was thrown out the window when Wall Street turned title to real property into confetti.

Jamie Dimon Meets With Obama Today

You Won't Find it in The Wall Street Journal

April 11, 2013

If President Obama is trying to make it clear that he reports to the 1 percent, not the average Americans who elected him, he’s earning an A+ on his report card.

At 6:46 p.m. last evening, the White House sent out the President’s schedule for today. One item on the agenda reads as follows: “Later in the morning, the President will meet with members of the Financial Services Forum as part of the organization’s daylong Spring Meeting. This meeting in the Roosevelt Room is closed press.” There is no mention in this press announcement that the President will be meeting with the CEOs of the too-big-to-fail banks – certainly a detail worthy of the public’s attention.

Early this morning, the Wall Street Journal’s link on the front page of its web site to its story on the President’s meet-up with members of the Financial Services Forum tells us the following: “PAGE UNAVAILABLE — The document you requested either no longer exists or is not currently available.” Fortunately, Google has cached the article and from it we learn that Jamie Dimon, Chairman and CEO of JPMorgan Chase (whose firm is under an FBI investigation for losing $6.2 billion of depositors’ money in a derivatives trading scheme) is expected to meet with the President at the White House today as part of the Financial Services Forum. Also expected to attend is Brian Moynihan, CEO of Bank of America...

by Pam Martens, Wall Street on Parade

The Corruption of Capitalism in America"

by David Stockman, New York Times, March 30, 2013

Over the last 13 years, the stock market has twice crashed and touched off a recession: American households lost $5 trillion in the 2000 dot-com bust and more than $7 trillion in the 2007 housing crash. Sooner or later - within a few years, I predict - this latest Wall Street bubble, inflated by an egregious flood of phony money from the Federal Reserve rather than real economic gains, will explode, too.

So the Main Street economy is failing while Washington is piling a soaring debt burden on our descendants, unable to rein in either the warfare state or the welfare state or raise the taxes needed to pay the nation’s bills. By default, the Fed has resorted to a radical, uncharted spree of money printing. But the flood of liquidity, instead of spurring banks to lend and corporations to spend, has stayed trapped in the canyons of Wall Street, where it is inflating yet another unsustainable bubble.

More.

David A. Stockman is a former Republican congressman from Michigan, President Ronald Reagan’s budget director from 1981 to 1985 and the author, most recently, of "The Great Deformation: The Corruption of Capitalism in America."

Secrets and Lies of the Bailout

by Matt Taibbi

Rolling Stone, January 17, 2013

It has been four long winters since the federal government, in the hulking, shaven-skulled, Alien Nation-esque form of then-Treasury Secretary Hank Paulson, committed $700 billion in taxpayer money to rescue Wall Street from its own chicanery and greed. To listen to the bankers and their allies in Washington tell it, you'd think the bailout was the best thing to hit the American economy since the invention of the assembly line. Not only did it prevent another Great Depression, we've been told, but the money has all been paid back, and the government even made a profit. No harm, no foul - right?

It has been four long winters since the federal government, in the hulking, shaven-skulled, Alien Nation-esque form of then-Treasury Secretary Hank Paulson, committed $700 billion in taxpayer money to rescue Wall Street from its own chicanery and greed. To listen to the bankers and their allies in Washington tell it, you'd think the bailout was the best thing to hit the American economy since the invention of the assembly line. Not only did it prevent another Great Depression, we've been told, but the money has all been paid back, and the government even made a profit. No harm, no foul - right?

Wrong.

It was all a lie - one of the biggest and most elaborate falsehoods ever sold to the American people. We were told that the taxpayer was stepping in - only temporarily, mind you - to prop up the economy and save the world from financial catastrophe. What we actually ended up doing was the exact opposite: committing American taxpayers to permanent, blind support of an ungovernable, unregulatable, hyperconcentrated new financial system that exacerbates the greed and inequality that caused the crash, and forces Wall Street banks like Goldman Sachs and Citigroup to increase risk rather than reduce it. The result is one of those deals where one wrong decision early on blossoms into a lush nightmare of unintended consequences. We thought we were just letting a friend crash at the house for a few days; we ended up with a family of hillbillies who moved in forever, sleeping nine to a bed and building a meth lab on the front lawn.

How Wall Street Killed Financial Reform

But the most appalling part is the lying. The public has been lied to so shamelessly and so often in the course of the past four years that the failure to tell the truth to the general populace has become a kind of baked-in, official feature of the financial rescue. Money wasn't the only thing the government gave Wall Street - it also conferred the right to hide the truth from the rest of us. And it was all done in the name of helping regular people and creating jobs. "It is," says former bailout Inspector General Neil Barofsky, "the ultimate bait-and-switch."

The bailout deceptions came early, late and in between. There were lies told in the first moments of their inception, and others still being told four years later. The lies, in fact, were the most important mechanisms of the bailout. The only reason investors haven't run screaming from an obviously corrupt financial marketplace is because the government has gone to such extraordinary lengths to sell the narrative that the problems of 2008 have been fixed. Investors may not actually believe the lie, but they are impressed by how totally committed the government has been, from the very beginning, to selling it.

Read more: http://www.rollingstone.com/politics/news/secret-and-lies-of-the-bailout-20130104#ixzz2JyBGoqwY

"The First Thing We Do,

Let's Kill All the Lawyers"

Henry VI by William Shakespeare

You may have heard that not one single banker has been charged with a crime for their rampage against the global economy during the past several years, but the California Bar Association has a different perspective on the problem. Not enough lawyers have been disbarred for trying to represent homeowners in foreclosure.

"Rage Among The Ruins" is a feature story by Eric Berkowitz in the February 2013 issue of California Lawyer, a free monthly magazine sent to 170,000 California lawyers.

California State Bar CEO Joe Dunn calls foreclosure relief "the Number 1 disciplinary challenge" his organization faces. From February 2009 to December 2012, the State Bar processed roughly 12,000 complaints against lawyers who allegedly sold clients worthless foreclosure relief services of one sort or another. Of those, 396 cases resulted in disbarments, and at this writing another 284 matters were under active investigation. "Most of our cases come from angry clients," says investigator Tom Layton, who worked on the State Bar's Mortgage Fraud Task Force. "We weren't ready for this kind of volume."

To protect unsuspecting homeowners, the State Bar, the state Attorney General's office, the Department of Real Estate, various district attorneys and U.S. Attorneys' offices, and now the new federal Consumer Financial Protection Bureau have been stepping up enforcement efforts against foreclosure relief scams. Setting up task forces, issuing consumer warnings, and filing lawsuits, these various agencies have brought down operations across California. But as long as troubled homeowners have hopes of keeping a roof over their heads, unscrupulous people will try to profit from their distress.

"Lawyers are involved at some level in most of the scams," says the State Bar's Dunn.

So next time you find a lawyer who is willing to invest 500 hours to help you to fight the banks and save your home from foreclosure, take the advice of William Shakespeare and the California Lawyer. Just shoot 'em.

Foreclosures Haunting Obama

by Ginyamin Appelbaum

New York Times, August 19, 2012

WASHINGTON - After inheriting the worst economic downturn since the Great Depression, President Obama poured vast amounts of money into efforts to stabilize the financial system, rescue the auto industry and revive the economy.

But he tried to finesse the cleanup of the housing crash, rejecting unpopular proposals for a broad bailout of homeowners facing foreclosure in favor of a limited aid program - and a bet that a recovering economy would take care of the rest.

During his first two years in office, Mr. Obama and his advisers repeatedly affirmed this carefully calibrated strategy, leaving unspent hundreds of billions of dollars that Congress had allocated to buy mortgage loans, even as millions of people lost their homes and the economic recovery stalled somewhere between crisis and prosperity.

The nation's painfully slow pace of growth is now the primary threat to Mr. Obama's bid for a second term, and some economists and political allies say the cautious response to the housing crisis was the administration's most significant mistake. The bailouts of banks and automakers are now widely regarded as crucial steps in arresting the recession, while the depressed housing market remains a millstone.

"They were not aggressive in taking the steps that could have been taken," said Representative Zoe Lofgren, chairwoman of the California Democratic caucus. "And as a consequence they did not interrupt the catastrophic spiral downward in our economy."

Mr. Obama insisted the government should help only "responsible borrowers," and his administration offered aid to fewer than half of those facing foreclosure, excluding landlords, owners of big-ticket homes and those judged to have excessive debts.

He decided to rely on mortgage companies to modify unaffordable loans rather than have the government take control by purchasing the loans, the approach advocated by his chief political rivals in the 2008 presidential race, Hillary Rodham Clinton and John McCain.

The Unrepentant and Unreformed Bankers

by Phil Angelides

San Francisco Cronicle August 18, 2012

That too much of Wall Street remains unchanged is not surprising. Simply stated, the banks and their leaders have paid no real economic, legal or political price for their wrongdoing and thus have not felt compelled to change.

On the economic front, the financial sector has rebounded nicely from its brush with death, thanks to an enormous taxpayer bailout. By 2010, compensation at publicly traded Wall Street firms had hit a record $135 billion.

Last year, the profits of the nation's five biggest banks exceeded $51 billion, with their chief executives all enjoying pay increases. By 2011, the 10 biggest U.S. banks held 77 percent of the nation's banking assets.

On the legal front, enforcement has been woefully inadequate. Federal criminal financial fraud prosecutions have fallen to a two-decade low. Violations are settled for pennies on the dollar - the mere cost of doing business, with no admission of wrongdoing and with the bill invariably picked up by insurers or shareholders. (When it's shareholders, that's not someone else far away, that's your 401(k), pension fund or mutual fund.)

May God Help Us All

by Mark Stopa, Florida attorney

Wanna Buy a Government-Foreclosed Home? OK. Just Bring $10,000,000.00

Posted on June 29th, 2012 by Mark Stopa

I've often expressed my disgust at how Fannie Mae and Freddie Mac frequently pay banks 100% of their judgment amounts in foreclosure cases. It's an appalling dynamic in foreclosure-world, one where banks often have no incentive to modify mortgages because "our" government will pay the banks in full once the foreclosure is over (and all the banks have to do is convey title to Fannie and Freddie). Incredibly, just when I thought I couldn't be any more appalled, somehow, my disgust with "our" government reached a new level today.

I have it on good information (directly from someone personally involved) that Fannie and Freddie are selling foreclosed homes in bulk to third-party investors. Not one at a time, not several - dozens - at heavily discounted rates. In other words, many of the homes in Florida and elsewhere that have been foreclosed, with lower and middle-class homeowners thrown onto the streets and title transferred to Fannie or Freddie, are being sold to third-party investors in bulk.

If you think that sounds like an interesting investment opportunity, a chance to purchase a new home after you were foreclosed, let me stop you. Fannie and Freddie aren't making these investments available to just anyone. To qualify, to even get inside the door to the auction room, you must have at least $10,000,000.00 in assets, and you must be able to prove the existence of those assets via bank statements and the like.

Ten million bucks, just to get in the door.

Is this what America has become? Throwing Americans onto the streets so "our" government pays the banks to foreclose and "our" government sells those houses in bulk at discounted rates to third-party investors with an eight-figure net worth?

Apparently so.

Sigh.

You know what's arguably even worse? Nobody is even talking about this. No news stories. No media coverage. Nothing. Would you have known about this if Mark Stopa - basically a nobody in the scope of national news and politics - hadn't blogged about it?

Why such secrecy? Where is the media coverage? Where's the outrage? Who is running our government, exactly? This is as big an issue as Obamacare - thousands of homeowners getting foreclosed and their homes being sold in bulk to the mega-wealthy. Why is nobody even talking about it? Is America really a land where our government takes houses from the poor and middle class and sells them in bulk at discounted rates to the mega-wealthy - and it does so completely in secret? Does anyone care?

This is why I consider this the biggest post I've ever written. This is what is driving the whole foreclosure crisis, and nobody knows about it. Nobody's even talking about it. Change is not possible without awareness, and right now, all Americans are totally in the dark about this dynamic. Well, all Americans except those who have $10,000,000.00.

May God help us all.

Mark Stopa

Leadership Vaccuum

Geithner against reducing mortgage principal

Obama pledged to use $50 billion from the $700 billion bank bailout approved by Congress in 2008 to help homeowners. Only about $3.7 billion of that has been spent.

Uncle Sam's Underwater Foreclosure Policy

"Sink, Baby, Sink!"

April 11, 2012. Massachusetts Attorney General Martha Coakley led a coalition of eleven states urging Fannie Mae and Freddie Mac to reverse its position and implement principle reduction in its loan modification program. Her letter to the FHFA on April 11 was joined by Attorneys General from California, Delaware, Illinois, Iowa, Maryland, Minnesota, New Mexico, New York, Oregon, and Vermont. AG Coakley said, "We will soon see the results of the country's largest banks implementing principal loan reduction as required under the recent Multistate Servicing Settlement. It is now time for the FHFA to accept the fact that principal forgiveness programs help borrowers, help communities and can improve the creditors' bottom line."

April 18, 2012. One week later, the New York Daily News urged NY Attorney General Eric Schneiderman to quit President Obama's mortgage unit. "The promises of the President have led to little or no concrete action," wrote Mike Gecan and Arnie Graf of the Metro Industrial Areas Foundation in an opinion piece for the Daily News. New York State Attorney General Eric Schneiderman should "distance himself from this cynical arrangement," they said.

The Residential Mortgage-Backed Securities Working Group was prominently featured in the State of the Union speech 85 days ago. It has accomplished nothing, according to the Daily News. Schneiderman has no office, no phones, no staff, and no executive director.

The Daily News article continues:

The settlement and working group - taken together - were a coup: a public relations coup for the White House and the banks. The media hailed the resolution for a few days and then turned their attention to other topics and controversies. But for 12 million American homeowners, collectively $700 billion under water, this was just another in a long series of sham transactions.

In fact, the new Residential Mortgage-Backed Securities Working Group was the sixth such entity formed since the start of the financial crisis in 2009. The grand total of staff working for all of the previous five groups was one, according to a surprised Schneiderman. In Washington, where staffs grow like cherry blossoms, this is a remarkable occurrence.

The Huffington Post reported on April 19, "In law enforcement time, three months isn't very long - investigations typically take months or even years. But the skepticism is hardly surprising, given the Obama administration's scattershot and largely underwhelming law enforcement response to the financial crisis. It's been five years since the subprime market crashed, and federal authorities mostly haven't prosecuted the individuals and institutions that created, marketed and rated the financial products that nearly brought down the American economy."

A recent New York Times/CBS poll found that 36 percent of respondents approve of the president's handling of the mortgage crisis, while 49 percent disapprove.

USA Today reports that almost 1 in 5 children in Nevada lived or live in owner-occupied homes that were lost to foreclosure or are at risk of being lost. The percentages are 15% in Florida, 14% for Arizona, and 12% for California. That's about one in eight children in California. Five years into the foreclosure crisis, an estimated 2.3 million children have lived in homes lost to foreclosure.

Chase is Bigger than Wells Fargo, BoA, Citi...

Too Big to Miss

Chasing Chase is hard to miss. JPMorgan is the country's biggest commercial bank by assets, with $2.416 trillion in assets, a number that has increased by half a trillion dollars since 2007, $757 billion worth of loans, $1.4 trillion in deposits, 260,000 employees all over the world. It is the biggest investment bank in the world, and it keeps getting bigger.

Second on the list? Goldman "We-Break-Our-Clients-for-Entertainment" Sachs. Huffington Post

One Hundred Years of Title Turmoil

MERS Madness will poison the U.S. well for a century

"When you get your pocket picked by a real pro, sometimes all you can do is appreciate the artistry. Such, apparently, is the case with MERS, a national electronic database of home mortgages that effectively swiped millions of dollars from local governments just when they could have used the revenue most." Thomas Brom, "In MERS We Trust", California Lawyer (March 2013). "Whether MERS Inc. can sustain a private, members-only registry of home mortgages remains to be seen."

"There can be no national solution - each state governs its own recording system," maintains David E. Woolley, principal of Harbinger Analytics Group in Tustin and a licensed land surveyor. Woolley predicted that a wave of boundary suits would eventually hit title insurers. "[T]ens of thousands of titles have been lost or diluted in a sea of MERS transactions, and may take a hundred years to fix," he and Manhattan Beach lawyer Lisa D. Herzog wrote in 8 HASTINGS BUS. L.J. 365, 367 (2012).

In 2010 Rep. Marcy Kaptur (D-Ohio) introduced a bill to prohibit Fannie Mae, Freddie Mac, and Ginnie Mae from owning or guaranteeing any mortgage assigned to MERS or for which MERS is the mortgagee of record. It died in committee in 2011 and again last year; in January 2013, Kaptur reintroduced the bill as H.R. 189. As of July 4, 2013, http://www.govtrack.us gives the bill a 3% chance of getting past committee and 1% chance of being enacted.

Land is America's most valuable asset. MERS may have put our national security at risk as property values crumble and insolvency is the enduring result of MERS mythology. Happy Fourth of July, MERS maniacs.

Rachael Maddow reports on the Meltdown

Interview with Jeff Thigpen, County Recorder

Rachael Maddow describes how the banks destroyed property values in the Unites States by trading title to property like casino chips. She reports that Occupy Greensboro in North Carolina trains volunteers to review documents in new foreclosures to find evidence of fraud, including robosigning. She interviews Jeff Thigpen, Register of Deeds for Guilford County NC, who says he can no longer tell who owns what.

Thigpen's staff conducted a study of 6,100 mortgage documents and discovered that 74 percent, about 4,500 transactions, had problems involving forged signatures and fraudulent documents. His research into robo-signing has been cited in a number of pending court cases as well as in the Associated Press, Business Week, and other national publications.

In March 2012, Thigpen's office took more than two dozen big banks and mortgage companies to court, including JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and MERSCorp., and charged them with wrecking 250 years of fair dealing in his county.

The lawsuit begins, "This lawsuit seeks to have defendants clean up the mess they created." Until the banks do that, he said, the people in his county cannot buy and sell property with any real confidence about who owns it.

MERS Foreclosure Fraud

Wisconsin State Journal

Friday, March 5, 2012

by Dee J. Hall

It used to be that if you wanted to find out who owned your mortgage, you could go to the office of your local register of deeds, the final authority on questions of property ownership.

But when banks set up their own private registration system to help them bundle and resell mortgages in a whirlwind of securities exchanges, the land offices of record had no hope of keeping up.

And when some banks later foreclosed on many of those properties, often cutting corners or worse - creating phony documents - it left register of deeds offices across Wisconsin awash in forged and fraudulent documents.

That's a "serious problem" for registrars charged with maintaining property records, said Brown County Register of Deeds Cathy Williquette Lindsay, who heads a committee studying foreclosure fraud on behalf of the Wisconsin Register of Deeds Association.

"It's troubling to know that in each of our offices, are thousands - and I mean thousands - of fraudulent documents," Williquette Lindsay said.

Registrars' offices across Wisconsin are littered with paperwork signed and sworn to by fictitious people, including "Linda Green," a handle commonly used by "robo-signers" - workers who signed off on foreclosure documents without verifying them.

"Not only did 'Linda Green' not sign it," Williquette Lindsay said, "but somebody fraudulently notorized it."

Across the country, officials tasked with keeping track of property ownership are increasingly alarmed about the prevalence of forged signatures and fraudulent affidavits among their records.

Last month, five major banks agreed to pay $25 billion to compensate homeowners and states for the fraudulent activity and to halt abusive practices, although they have admitted no wrongdoing.

In separate legal actions, several local governments and three states - Massachusetts, New York and Delaware - have sued the major banks and the private record-keeping service they employ, the Mortgage Electronic Registration System (MERS), alleging they have flooded the courts and registrars' offices with inaccurate, fraudulent and forged documents.

John O'Brien, head of the Southern Essex District Registry of Deeds in Massachusetts, was among the first to raise the alarm about potential foreclosure fraud in November 2010. Last year, O'Brien's office commissioned a study of 473 mortgages issued to and from JP Morgan Chase Bank, Wells Fargo Bank and Bank of America during 2010.

The review found just 16 percent of the records in the Essex County office assigning ownership of the mortgages were valid. The rest had been back-dated, robo-signed or had other problems, including broken chains of title.

Kevin Harvey, the county's first assistant register, said O'Brien's office has asked 80 financial institutions to file affidavits verifying that the records they have previously submitted were legitimate.

"Guess how many banks have signed the affidavit?" Harvey asked. "None."

Transactions obscured

At the heart of the controversy is MERS, founded about 15 years ago by the large banks and now used by roughly 3,000 mortgage-related entities. MERS was to be a central storehouse that streamlined the process of registering and transferring loans secured by property, which previously had been the exclusive purview of county registrars' offices.

But the private registration system has also created chaos, uncertainty and injected fraud into the nation's property records, New York Attorney General Eric Schneiderman charged in a lawsuit against MERS on Feb. 3.

The lawsuit alleges the system effectively eliminated the public's ability to track property transactions by registering properties in the name of MERS rather than the bank that owns the mortgage. That allows member institutions to move loans quickly and multiple times without having to record each move with the local registrar's office.

The lawsuit claims the MERS system has led to a loss of $2 billion in fees nationally from local registrars' offices. And some of the information MERS does have, the lawsuit alleges, is "unreliable and inaccurate."

The Reston, Va.-based company said it is following the law and has become an important part of the mortgage industry.

"MERS does not hide ownership or undermine the integrity of land records," the company said in response to Schneiderman's suit. "Any mortgage holder registered in the MERS System can easily access information related to their mortgage on our website or through a toll-free number."

The company added that federal law already requires that consumers be notified when the owner or servicer of their loan changes.

"County land records were not intended to identify the servicer of a mortgage or the current note holder," the company said, "they are intended to provide notice to purchasers of property that there is a lien on the property and when that lien was perfected."

But Williquette Lindsay said very little information is made available to homeowners by MERS. Property owners visiting their local register of deeds offices to find out who owns their mortgage to prepare for a bankruptcy or defend against foreclosure often leave empty-handed, she said.

"They want to know who is their lender of record, and we can't tell them," Williquette Lindsay said.

When Nevada began requiring transfers of mortgage ownership be recorded in the local recorder's office in October, foreclosures in that state dropped sharply.

'Bizarre' and 'complex'

Schneiderman's suit described MERS as a "bizarre" and "complex" entity that has few employees but which has designated at least 20,000 people working for its member institutions to sign documents on its behalf.

In some cases, MERS-designated officials sign documents "assigning" mortgages from MERS - which actually is only a registration system and owns no mortgages at all - to their own companies or clients to prove ownership in foreclosure actions, Schneiderman said.

Madison attorney Briane Pagel said he has been unable to get any information out of MERS to help his clients fighting foreclosure.

"We have a property recording system that dates back to the Middle Ages," he said, "and MERS has just about destroyed it."

Capitalism is "Out of Whack"

The President Sends Bank Lawyers after the Banks

U.S. Attorney General Eric Holder and Lanny Breuer, head of the Justice Department's criminal division, were partners for years at a Washington law firm that represented a Who's Who of big banks and other companies at the center of alleged foreclosure fraud, a Reuters investigation shows. While Holder and Breuer were partners at Covington, the firm's clients included the four largest U.S. banks - Bank of America, Citigroup, JP Morgan Chase and Wells Fargo. The traffic between the Justice Department and Covington & Burling has been non-stop. In 2010, Holder's deputy chief of staff, John Garland, returned to Covington. So did Steven Fagell, who was Breuer's deputy chief of staff in the criminal division. The revolving door between the Obama administration and Big Banks never stops turning.

President Obama announced in his State of the Union address on January 24, 2012, that he was creating a special unit within the Financial Fraud Enforcement Taskforce to deal with mortgage origination and securitization abuses:

And tonight, I am asking my Attorney General to create a special unit of federal prosecutors and leading state attorneys general to expand our investigations into the abusive lending and packaging of risky mortgages that led to the housing crisis. This new unit will hold accountable those who broke the law, speed assistance to homeowners, and help turn the page on an era of recklessness that hurt so many Americans.

The members of the new Mortgage Securitization Abuses Unit were identified as New York Attorney General Eric Schneiderman; Assistant U.S. Attorney General Lanny Breuer; Robert Khuzami, Director of Enforcement at the SEC; John Walsh, U.S. Attorney, District of Colorado; and Tony West, Assistant Attorney General, Civil Division, Department of Justice. AG Eric Holder, sitting near the podium, was blinking so fast as Obama said he would rein in the banks that I could only assume he was on LSD - but the kinder interpretation would be that people often blink more rapidly when they are feeling distressed or uncomfortable.

New York Attorney General Schneiderman and Delaware Attorney General Beau Biden have been among the most outspoken regarding the prosecution of crimes relating to mortgage securitization. Schneiderman released a statement after the President's address: "In coordination with our federal partners, our office will continue its steadfast commitment to holding those responsible for the economic crisis accountable, providing meaningful relief for homeowners commensurate with the scale of the misconduct, and getting our economy moving again. The American people deserve a robust and comprehensive investigation into the global financial meltdown to ensure nothing like it ever happens again, and today's announcement is a major step in the right direction."

Abigail Caplovitz Field wrote in Reality Check on January 24, 2012, "Schneiderman isn't chairing anything. He's Co-Chairing. That's a huge difference. If he's Chair he's in charge. If he's Co-Chair he needs consensus. And who is he Co-Chairing with? Four people, starting with Lanny Breuer. That's unacceptable...Why has Breuer failed to go after the people who committed 'misconduct and illegalities that contributed to both the financial collapse and the mortgage crisis'? Is it because he's an ex- (and likely future) Covington & Burling partner? Doesn't matter. His track record speaks for itself. There is only one reason to have him co-chair with Schneiderman, and that's to rein Schneiderman in."

On January 31, Bill Black wrote, "The federal government does not intend to prosecute criminally the large financial firms and their senior officers who committed hundreds of billions of dollars in fraudulent mortgage originations. That figure only counts the fraudulent liar's loans the five large banks made. The total amount of mortgage origination fraud through liar's loans exceeds $1 trillion. The five banks' civil liability for mortgage origination fraud is vastly larger than their civil liability for their endemic foreclosure fraud."

"Capitalism is out of whack," said Klaus Schwab, founder and president of the World Economic Forum. "We have sinned," he said, adding that this year's forum in Davos, Switzerland, will place particular emphasis on ethics and resetting the moral compass of the world's business and political community. New Zealand Herald 1/26/2012.

The Amazing Disappearing Bank

Chase Halts Lawsuits to Collect Credit Card Debt

American Banker Jan. 13, 2012

JPMorgan Chase & Co. has quietly ceased filing lawsuits to collect consumer debts around the nation, dismissing in-house attorneys and virtually shutting down a collections machine that as recently as nine months ago was racking up hundreds of millions of dollars in monthly judgments.

Jerry Salzberg, a lawyer who represents debt collectors and banks in the Chicago area, was familiar with Chase's dismissed Illinois collections attorneys, whom he describes as experienced, productive and profitable.

"Someone from New York brought in the three lawyers, kicked them out with no warning and dismissed all their cases," Salzberg says. "These were people who were by the book. ...If they weren't the most profitable [of Chase's regional collection teams], they sure as hell were making a lot of money for the bank. ...Obviously something happened."

Chase collections cases have dropped off sharply in Illinois in recent months, in addition to disappearing in five other states, an American Banker review indicates. The review focused on California, Florida Maryland, New York and Washington, where local court records are electronically searchable.

After recouping $405 million in the first quarter of 2011, Chase's recoveries fell to $321 million in the second quarter and $266 million in the third quarter.

It is not clear why Chase is walking away from billions of dollars of claims, but the number is likely to climb as word gets out that Chase is climbing out of the ring.

Here We Go Again

2012 was another stunning year

The system continues to crumble. "House prices have fallen an average of 33 percent from their 2006 peak, resulting in about $7 trillion in household wealth losses and an associated ratcheting down of aggregate consumption," according to a Federal Reserve White Paper that Fed Chairman Ben Bernanke provided to the chairmen and ranking members of the House and Senate banking committees on January 4, 2012. It states:

"...the large inventory of foreclosed or surrendered properties is contributing to excess supply in the for-sale market, placing downward pressure on house prices and exacerbating the loss in aggregate housing wealth. At the same time, rental markets are strengthening in some areas of the country, reflecting in part a decline in the homeownership rate. Reducing some of the barriers to converting foreclosed properties to rental units will help redeploy the existing stock of houses in a more efficient way. Such conversions might also increase lenders' eventual recoveries on foreclosed and surrendered properties."

Thank you, Chairman Bernanke, for those snappy remarks. Deploy means to move troops into position for action. Maybe your troops can establish base camps filled with barracks to deploy the millions of families who were marched out of the "existing stock of houses."

Bank of America's CEO Brian Moynihan earned $2.26 million in 2011, while his bank's market value dropped 60%. Chase CEO Jamie Dimon took home $41.9 million — the most among bank CEOs — for steering a bank that lost 23% of its stock value in 2011. Goldman's Lloyd Blankfein pocketed nearly $22 million, while his investment bank lost more than 46% of its market value. You gotta pay top dollare to lose money at that rate.

Compensation pools at seven of the biggest U.S. banks totalled about $156 billion (including salaries, benefits and bonuses) in 2011, which is 3.7% higher than the record breaking number set in 2010. Truthout January 2, 2012.

Bankruptcy attorney Max Gardner's prediction for 2012:

The number of homes in foreclosure will double or triple from 2011 levels and home values will drop by another 15% to 20% by the end of year. I do not expect to see any real recovery in the housing market until at least 2022. A massive number of bank-owned homes (Real Estate Owned or REO property) will be turned into rental properties by the banks and/or mortgage servicers and many more foreclosed on homes will be sold in bulk sales to investors for the same purpose.

Bank of America will be forced into liquidation under the too big to fail provisions of the Dodd Frank Act. The FHFA as conservator of BoA may impose the Chapter 13 principal reduction program for all loans owned and serviced by the Bank.

On November 26, 2012, Foreclosure Radar recorded its millionth California foreclosure sale since January 2007. On average, more than 500 California families have lost their homes every day since 4Q 2007. California foreclosure activity remains elevated, with more than 30,000 completed foreclosures each quarter, compared to less than 3,500 foreclosures in 3Q 2006. Cumulative Foreclosure Totals Have Devastated California Communities: Since 4Q 2007 - the unofficial beginning of the economic crisis - through 4Q 2011, more than 1.5 million Californians received notices of default on their homes. More than 785,000 California families actually lost their homes to foreclosure during the same period. Ten of the top 20 metro foreclosure areas nationwide for 2011 were in California. For mortgages originated between 2004 and 2008, Latino and African-American homeowners in California experienced foreclosure rates 2.1 and 1.7 times that of non-Hispanic White homeowners through February 2011. Latinos accounted for 22 percent of all loans made between 2004 and 2008, but 37% of California foreclosures for the same time period. In 2011 Santa Barbarians received 2307 notices of trustee sales and 1799 notices in 2012. Currently, one in three California owners with a mortgage is underwater.

Santa Barbara has not escaped the housing collapse. Consider the Old Masini Adobe in Montecito. Almost 200 years old, this vintage piece of history is considered to be the oldest 2-story adobe. Built in 1820, this Monterey Colonial is a historical landmark situated on 3/4 acre on 129 Sheffield Drive. Originally listed at $3 million, then reduced to $2.5 million, it sold at the end of 2011 for $791,000.

Notices of Trustee's Sale recorded in Santa Barbara County:

2007-2011: 10,946

2002-2006: 880

Foreclosures in Santa Barbara increased 12-fold in the most recent five years compared to the previous five years.

Killinger/Rotella Settle for $64 Million

Insurance will pay most of the FDIC's latest joke

New York Times Dec. 14, 2011

The Federal Deposit Insurance Corp. has settled their $900 million lawsuit against three former top executives of Washington Mutual for $64 million (7 cents on the dollar). The FDIC in March 2011 sued WaMu CEO Kerry Killinger, COO Steven Rotella, and home-loans President David Schneider, accusing them of "gross mismanagement" of WaMu's mortgage business that ultimately led to the lender's failure in September 2008. The FDIC accused the executives of pushing Washington Mutual to the brink by making risky bets to reap short-term profits for themselves.

Most of the settlement will be paid by WaMu's directors' and officers' (D&O) insurance. Only $400,000 in total will be paid by the executives. Killinger's $133,000 share of the settlement will be a tiny drop in the bucket — he collected $103 million between 2003 and 2008 as his compensation for steering WaMu into the ground.

"The system's broken"

-Rich Sharga, Sr. Vice President, RealtyTrac

With the nation's foreclosure system all but paralyzed after an avalanche of loan failures and "robo-signing" scandals, many delinquent homeowners are defying lenders and staying put. Instead of packing up and slinking away, they're living for free, sometimes for years. They're hiring lawyers to challenge their cases, and many are winning reprieves or causing the process to stall even further.

"They go into a perpetual state of limbo where nothing happens or the case goes very slowly," says attorney, Mark Stopa.

The extraordinary delays are hampering hope of a housing market recovery and pushing this year's troubles into next year, says Rich Sharga, senior vice president at RealtyTrac, which tracks foreclosure data. The logjam also has kept thousands of new cases from being filed. "The system's broken," he says.

The AARP article continues, "Often, banks are not pushing to go to foreclosure. They seem to be in no hurry to add to their swollen inventory of repossessed homes, which now stands at a near record 862,000 nationwide.

"Also contributing to the gridlock is intense scrutiny by regulators stemming from the scandals in which banks cut corners and falsified documents to rush homeowners to foreclosure. Until their cases are resolved, owners can legally remain in homes they would've lost long ago in normal times.

"The banks' paperwork was so messed up in so many cases that it's mind-boggling," says Florida lawyer Peter Ticktin. "The delay is huge."

Realty Trac's Top 10 College Towns for Buying Foreclosures

It's the time of year when proud parents are sending their kids off to college while booster clubs are revving up for the impending college football season. What better time to consider the best college towns in the nation for investing in foreclosures? Read about the Top 10 college towns for smart investors.

FHFA sues Chase for $33 billion

17 banks sued for $196 billion on September 2, 2011

The Federal Housing Finance Agency (FHFA), as conservator for Fannie Mae and Freddie Mac, filed lawsuits against 17 financial institutions, certain of their officers and various lead underwriters. The suits allege violations of federal securities laws in the sale of residential private-label mortgage-backed securities to Fannie Mae and Freddie Mac.

Complaints have been filed against the following lead defendants:

- JPMorgan Chase & Co. - $33 billion

- The Royal Bank of Scotland Group PLC - $30.4 billion

- Countrywide Financial Corporation - $26.6 billion

- Merrill Lynch & Co. - $24.8 billion

- Deutsche Bank AG - $14.2 billion

- Credit Suisse Holdings (USA), Inc. - $14.1 billion

- Goldman Sachs & Co. - $11.1 billion

- Morgan Stanley - $10.6 billion

- HSBC North America Holdings, Inc. - $6.2 billion

- Ally Financial Inc. f/k/a GMAC, LLC - $6 billion

- Bank of America Corporation - $6 billion

- Barclays Bank PLC - $4.9 billion

- Citigroup, Inc. - $3.5 billion

- Nomura Holding America Inc. - $2 billion

- Societe Generale - $1.3 billion

- First Horizon National Corporation - $883 million

- General Electric Company - $549 million

The complaints are available on the FHFA website.

The SEC Systematically Destroyed Evidence

Crooks in all the wrong places - the heat rises...

From Matt Taibbi's article in Rolling Stone August 17, 2011

Much has been made in recent months of the government's glaring failure to police Wall Street; to date, federal and state prosecutors have yet to put a single senior Wall Street executive behind bars for any of the many well-documented crimes related to the financial crisis. Indeed, Flynn's accusations dovetail with a recent series of damaging critiques of the SEC made by reporters, watchdog groups and members of Congress, all of which seem to indicate that top federal regulators spend more time lunching, schmoozing and job-interviewing with Wall Street crooks than they do catching them. As one former SEC staffer describes it, the agency is now filled with so many Wall Street hotshots from oft-investigated banks that it has been "infected with the Goldman mindset from within."

The destruction of records by the SEC, as outlined by Flynn, is something far more than an administrative accident or bureaucratic fuck-up. It's a symptom of the agency's terminal brain damage. Somewhere along the line, those at the SEC responsible for policing America's banks fell and hit their head on a big pile of Wall Street's money - a blow from which the agency has never recovered. "From what I've seen, it looks as if the SEC might have sanctioned some level of case-related document destruction," says Sen. Chuck Grassley, the ranking Republican on the Senate Judiciary Committee, whose staff has interviewed Flynn. "It doesn't make sense that an agency responsible for investigations would want to get rid of potential evidence. If these charges are true, the agency needs to explain why it destroyed documents, how many documents it destroyed over what time frame and to what extent its actions were consistent with the law."

The system is broken.

"It's Been an Unmitigated Disaster"

- Jamie Dimon, July 14, 2011

BLOOMBERG - JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said clashes over faulty mortgages may drag on as investors and regulators demand compensation for soured loans issued at the peak of the housing market.

"There have been so many flaws in mortgages that it's been an unmitigated disaster," Dimon said during a conference call on July 14. "We just really need to clean it up for the sake of everybody. And everybody is going to sue everybody else, and it's going to go on for a long time."

How can anybody not like Jamie Dimon? He shows the resilience and common sense of a captain who can weather the storm. JPMorgan disclosed about $2.5 billion in second-quarter costs tied to faulty mortgages and foreclosures. The bank added $1.27 billion to litigation reserves, mostly for mortgage matters, and incurred $1 billion of expenses tied to foreclosures. While millions of families are being thrown out on the streets, lawyers working for the banks are making billions! Maybe all that money will trickle down as the lawyers buy cocktails, and golf clubs, and thousand-dollar suits.

Banks Can't Prove They Own The Loan

The Wall Street Journal Picks Up the Scent

An article by Nick Timiraos appeared in The Wall Street Journal on June 1, 2011 - "Banks Hit Hurdle to Foreclosures."

"Banks trying to foreclose on homeowners are hitting another roadblock," Timiraos writes, "as some delinquent borrowers are successfully arguing that their mortgage companies can't prove they own the loans and therefore don't have the right to foreclose."

If you (or I) try to boot a homeowner into the street without any proof that we're entitled to the property, the cops will lock us up. Stealing is stealing, whether it is somebody's wallet or their 3-bedroom 2-bath in the suburbs with two dogs and a kid. When a bank tries to steal the bungalow without proof that they have a right to foreclose, it's a "hurdle" or "another roadblock."

Semantics aside, this is good news for all people holding grant deeds. This year, the Journal reports, cases in California, North Carolina, Alabama, Florida, Maine, New York, New Jersey, Texas, Massachusetts and other states have raised questions about whether banks properly demonstrated ownership.

In some cases, borrowers are showing courts that banks failed to properly assign ownership of mortgages after they were pooled into mortgage-backed securities. In other cases, borrowers say that lenders backdated or fabricated documents to fix those errors.

"Flawed mortgage-banking processes have potentially infected millions of foreclosures, and the damages against these operations could be significant and take years to materialize," said Sheila Bair, chairman of the Federal Deposit Insurance Corp., in testimony to a Senate committee last month.

In March, an Alabama court said J.P. Morgan Chase & Co. couldn't foreclose on Phyllis Horace, a delinquent homeowner in Phenix City, Ala., because her loan hadn't been properly assigned to its owners - a trust that represents investors - when it was securitized by Bear Stearns Cos. The mortgage assignment showed that the loan hadn't been transferred to the trust from the subprime lender that originated it.

This WSJ story represents a seismic shift in the foreclosure meltdown. Judges read The Wall Street Journal. So does Jamie Dimon. These hurdles, these roadblocks, are early warning signs that the bridges are washed out—proceed with caution.

The People vs. Goldman Sachs

Sen. Carl Levin's Report Indicts the Goldman Crown

On April 13, 2011, the Senate Subcommittee on Investigations, chaired by Democrat Carl Levin of Michigan, alongside Republican Tom Coburn of Oklahoma, released a 650-page bipartisan report, Wall Street and the Financial Crisis: Anatomy of a Financial Collapse.

"Goldman seemed to count on the unwillingness or inability of federal regulators to stop them - and when called to Washington last year to explain their behavior, Goldman executives brazenly misled Congress, apparently confident that their perjury would carry no serious consequences. Thus, while much of the Levin report describes past history, the Goldman section describes an ongoing crime - a powerful, well-connected firm, with the ear of the president and the Treasury, that appears to have conquered the entire regulatory structure and stands now on the precipice of officially getting away with one of the biggest financial crimes in history.

"Goldman was like a car dealership that realized it had a whole lot full of cars with faulty brakes. Instead of announcing a recall, it surged ahead with a two-fold plan to make a fortune: first, by dumping the dangerous products on other people, and second, by taking out life insurance against the fools who bought the deadly cars."

Goldman Sachs was President Obama's number-one private campaign contributor. Hank Paulson, U.S. Treasury Secretary (2006-2009) was CEO of Goldman Sachs and was worth $700 million when George W. Bush appointed him to his Cabinet. Paulson then put Edward M. Liddy, a Goldman Sachs director, in charge of AIG and gave AIG $85 billion. For more names of Goldman troopers in the Executive Branch, see "The Guys from Government Sachs" NY Times, Oct. 17, 2008.

In January 2011, Obama named William Daley, vice chairman at JPMorgan Chase, to be his new chief of staff — the man who controls who sees the President. An SEC filing shows that Daley owns $7.7 million worth of stock (175,678 shares) in Chase, a $2.1 trillion behemoth and the nation's second-largest bank. Daley headed Chase's Corporate Responsibility division, which included oversight of the firm's lobbyists and relations with government officials. With Wall Street lobbyists patrolling the Oval Office, we rest assured that the President is in good company.

Obama photo: Douglas Gillies

The 639-page Subcommittee report devoted 183 pages to WaMu, which was acquired by Chase in Sept. 2008:

Internal emails at Moody's and Standard & Poor demonstrate that senior management and ratings personnel were aware of the deteriorating mortgage market and increasing credit risk. In June 2005, for example, an outside mortgage broker who had seen the head of S&P's RMBS Group, Susan Barnes, on a television program sent her an email warning about the "seeds of destruction" in the financial markets. He noted that no one at the time seemed interested in fixing the looming problems.

"I have contacted the OTS, FDIC and others and my concerns are not addressed. I have been a mortgage broker for the past 13 years and I have never seen such a lack of attention to loan risk. I am confident our present housing bubble is not from supply and demand of housing, but from money supply. In my professional opinion the biggest perpetrator is Washington Mutual. 1) No income documentation loans. 2) Option ARMS (negative amortization)...5) 100% financing loans. I have seen instances where WAMU approved buyers for purchase loans where the fully indexed interest only payments represented 100% of borrower's gross monthly income. We need to stop this madness!!!" (Levin Report p. 269)

At the same time that WaMu was implementing its high risk lending strategy, WaMu and Long Beach engaged in a host of shoddy lending practices that produced billions of dollars in high risk, poor quality mortgages and mortgage backed securities. Those practices included qualifying high risk borrowers for larger loans than they could afford; steering borrowers from conventional mortgages to higher risk loan products; accepting loan applications without verifying the borrower's income; using loans with low, short term "teaser" rates that could lead to payment shock when higher interest rates took effect later on; promoting negatively amortizing loans in which many borrowers increased rather than paid down their debt; and authorizing loans with multiple layers of risk. (Levin Report p. 2)

Federal Reserve Consent Orders

Big Banks Promise to be Better Bandits

The Wall Street Journal reported that U.S. regulators hit the nation's largest banks with sweeping penalties for improper home-foreclosure practices, issuing detailed orders to revamp the way they deal with troubled borrowers.

The orders issued on Wednesday, April 13, 2011, to 14 financial institutions didn't include fines. Officials said they are coming. The orders were issued by the Federal Reserve, the Office of Thrift Supervision (OTS), and the Comptroller of the Currency.

Update: On February 9, 2012, the OCC announced the fines, totalling $394 million, including:

- $164 million for Bank of America

- $34 million for Citibank

- $113 million for JPMorgan Chase

- $83 million for Wells Fargo

This announcement came on the same day that the U.S. government announced a $25 billion settlement with five of the nation's largest banks over charges of systemic and widespread mortgage fraud. Thursday, February 9, 2012, may one day be memorialized as the day everything changed, as with the Magna Charta and the Declaration of Independence. Let the festivities begin.

Under the orders, banks have 60 days to establish plans to clean up their mortgage-servicing processes to prevent documentation errors. The orders also direct banks to take steps to ensure they have enough staff to handle the flood of foreclosures, that foreclosures don't happen when a borrower is receiving a loan modification, and that borrowers have a single point of contact throughout the loan-modification and foreclosure process.

Banks must hire an independent consultant to conduct a "look back" of all foreclosure proceedings from 2009 and 2010 to evaluate whether they improperly foreclosed on any homeowners and require each company to establish its own process to consider whether to compensate borrowers who have been harmed.

The OCC, which has been the target of most criticism, defended the enforcement orders. Acting Comptroller of the Currency John Walsh said, "The banks are going to have to do substantial work, bear substantial expense to fix the problems that we identified" as well as to identify and compensate homeowners that suffered financial harm.

It is the latest effort to cobble together a broken system with duct tape. President Obama launched HAMP in March 2009 and offered loan mods as a solution to the foreclosure meltdown. Fewer than 2 million trial modifications were started in the first two years of the program, and fewer than 800,000 converted to permanent modifications.

Here are links to the Consent Orders signed by the Federal Reserve on April 13, 2011. You be the judge whether they will stop the abuse. Better yet, ask your trial judge to take judicial notice of the consent order.

In order of assets (total = $9,512,340,569):

- Bank of America $2,340,667,014

- JPMorgan Chase $2,135,796,000

- CitiBank $2,002,213,000

- Wells Fargo $1,223,630,000

- Metlife $565,566,452

- HSBC $345,382,871

- U.S. Bancorp $282,428,000

- PNC $265,432,977

- Ally $179,428,000

- Suntrust $171,796,255

- plus LPS and MERS

Meanwhile, the soaring U.S. National Debt (below) is now half a trillion dollars greater than the combined assets of the nation's thirty largest banks (based on figures provided by InfoPlease.com). How much of that debt was assumed to bail out the banks?

The U.S. National Debt

Government Gone Wild

The U.S. government debt on May 15, 2012 was $15.7 trillion — $50,152 for every man, woman, and child residing in the U.S. (the current total is 312,820,593). The interest on the national debt in 2011 was $454 billion—more than the combined budgets of the Departments of Justice, Homeland Security, Energy, Transportation, Health & Human Services, Agriculture, Treasury, Labor, Commerce, plus HUD and the Small Business Administration. So Americans pay more to the bankers than to all of those departments combined. Since 1988, the U.S. has paid $8 trillion in interest. The

New York Times reported on Aug. 16, 2010, that the United States economy was valued at $4 trillion. China was number two at $1.33 trillion. Forecasts predict that China will surpass the United States as the world's biggest economy in twenty years - and America's interest payments to China will put China on top.

If the United States were to make daily payments of $100 million, it would take 422 years to pay off the national debt. Just nine months ago, it was going to take 389 years, so the U.S. has gone into debt for another 33 years - if it makes payments of $100 million per day for 422 years without missing a payment. We're only 235 years old as a country. We may be a deadbeat nation, but since the U.S. spends half of its budget on "defense" (stuff that kills people), what are they going to do about it? They can't touch US with a ten-foot pole.

Chase's profits jump 67% in Q1 2011

"There is a lot of money washing around the world

and obviously we are the beneficiary of that"

- Jamie Dimon, CEO, JPMorgan Chase, April 13, 2011

Kevin Drawbaugh

Reuters

April 14, 2011

Baltimore Sun

Senator Carl Levin, chair of the Senate's Permanent Subcommittee on Investigations, releasing the findings of a two-year inquiry yesterday, said he wants the Justice Department and the Securities and Exchange Commission to examine whether Goldman Sachs violated the law by misleading clients who bought collateralized debt obligations without knowing the firm would benefit if they fell in value.

The Michigan Democrat also said federal prosecutors should review whether to bring perjury charges against Goldman Sachs Chief Executive Officer Lloyd Blankfein and other current and former employees who testified in Congress last year. Levin said they denied under oath that Goldman Sachs took a financial position against the mortgage market solely for its own profit, statements the senator said were untrue.

"In my judgment, Goldman clearly misled their clients and they misled the Congress," Levin said at a press briefing yesterday where he and Senator Tom Coburn, an Oklahoma Republican, discussed the 640-page report from the Permanent Subcommittee on Investigations.

"Blame for this mess lies everywhere - from federal regulators who cast a blind eye, Wall Street bankers who let greed run wild, and members of Congress who failed to provide oversight," said Republican Senator Tom Coburn, the subcommittee's top Republican.

Washington Mutual - which became the largest failed bank in U.S. history in 2008 - embraced a high-risk home loan strategy in 2005 while its own top executives were warning of a bubble that "will come back to haunt us."

The report said a runaway mortgage securitization machine churned out abusive loans, toxic securities, and big fees for lenders and Wall Street.

It cited internal emails by Wall Street executives that described mortgage-backed securities underlying many collateralized debt obligations, or CDOs, as "crap" and "pigs."

It said Washington Mutual - which became the largest failed bank in U.S. history in 2008 - embraced a high-risk home loan strategy in 2005 while its own top executives were warning of a bubble that "will come back to haunt us."

Investment banks, it said, charged $1 million to $8 million in fees to construct, underwrite and sell a mortgage-backed security in the bubble, and $5 million to $10 million per CDO.

In the case of one CDO, Hudson Mezzanine Funding 2006-1, Goldman Sachs told investors its interests were "aligned" with theirs while the firm held 100 percent of the short side, according to the report.

Meanwhile, JPMorgan Chase & Co. posted a 67% jump in first-quarter profit thanks to an improving U.S. economy. "There is a lot of money washing around the world, and obviously we are the beneficiary of that," Jamie Dimon, JPMorgan's chief executive, said during a call with analysts after releasing the earnings Wednesday.

JPMorgan earned $5.6 billion, or $1.28 a share, in the first three months of 2011, up from $3.3 billion, or 74 cents, in the first quarter of 2010. The Baltimore Sun ran a mug shot of JPMorgan Chase:

Lawless Lawyers Lead to Outlaw Banks

1.New York Attorney General Issues Subpoenas

The New York Times reported on April 8, 2011, that the New York attorney general has issued subpoenas against the state's largest foreclosure law firm. Representing JPMorgan Chase, Wells Fargo, and other large banks, the Steven Baum law firm has handled an estimated 40 percent of foreclosure cases in the state. Since the end of 2007, Baum has filed more than 50,000 foreclosure cases in New York, according to data compiled by the New York State Unified Court System. The firm employs approximately 70 lawyers.

Judges in courts across New York state have rejected scores of cases filed by the Baum firm, saying it has failed to provide the documentation necessary to commence foreclosure. The firm might do better in California, where judges routinely dismiss lawsuits filed by homeowners without requiring that the foreclosing banks produce anything but a Trustee's Deed Upon Sale. In California, as in many states, "non judicial" means "no judge."

2. Judges crack down on Florida lawyers

Fifty thousand families on the street is by no means a record for bare-fisted law firms. Florida attorney David J. Stern prosecuted 70,400 foreclosures in 2009 with a staff of 1,200. Stern purchased a 130-foot yacht, The Misunderstood, as his fortunes rose. He bought the house adjacent to his $15 million mansion in The Harborage, Fort Lauderdale, and tore it down to build a waterfront tennis court. The Palm Beach Post reported that Stern laid off 70 percent of his staff one day last November. The Misunderstood was offered for sale for $18 million at the Miami Yacht Show last month. Stern is selling his $7 million cabin near Vail and two ocean-front properties in Hillsboro Beach, Florida, with a combined value of $17 million. Stern is now under investigation by the Florida Attorney General, and he stopped repossessing houses in March.

Stern sent letters to the chief judges of Florida's 20 circuit courts announcing that he intended to violate court rules and dump 100,000 foreclosure cases without a judge's order.

"We no longer have the financial or personnel resources to continue to file Motions to Withdraw in tens of thousands of cases that we still remain as counsel of record," Stern wrote, suggesting that the judges treat the pending cases "as you deem appropriate."

The Sun-Sentinel reported on April 4, 2011, that judges throughout Florida are increasingly dismissing cases and accusing lawyers of "fraud upon the court."

A Palm Beach Post review of cases in state and appellate courts found judges are routinely dismissing cases for questionable paperwork. Although in most cases the bank is allowed to refile the case with the appropriate documents, in a growing number of cases judges are awarding homeowners their homes free and clear after finding fraud upon the court.

In February, Miami-Dade County Circuit Judge Maxine Cohen Lando took one of the largest foreclosure law firms in the state to task. She called Marc A. Ben-Ezra, founding partner of Ben-Ezra & Katz P.A., before her to explain discrepancies in a case handled by an attorney in his Fort Lauderdale-based firm.

"This case should have never been filed," said Lando, who referred to the firm's work on the case as "shoddy" and "grossly incompetent." She called Ben-Ezra a "robot" who filed whatever the banks sent him, and held him in contempt of court. She then gave the homeowner the home - free and clear - and barred the lender from refiling the foreclosure.

Fannie Mae fired the Ben-Ezra law firm in February and then sued the firm on February 11 to recover 15,000 foreclosure case files, according to Courthouse News.

JPMorgan Chase fired the Ben-Ezra law firm on March 8, 2011, and then sued them to recover thousands of foreclosure case files, promissory notes, and mortgages that Chase alleges are being held hostage by its former foreclosure attorneys to collect outstanding legal bills. The case was filed in federal district court (SDFL) on March 25, 2011, Case No. 11-60655. Chase alleges that the files are worth $400 million.

3. Follow the Heat to Beat the Bank

Much of the fraudulent paperwork was manufactured by the banks. So the banks are providing paperwork to their lawyers and then suing the lawyers to get their felonious files back while the lawyers take the fall for the banks. The cases are being reported by the press in stories that fail to mention the names of the banks.

The judges shoot the messengers, putting law firms out of business, and tap the banksters on the wrist. Wading through a tsunami of foreclosures, how well does it punish the bank to lose one house in foreclosure when banks are foreclosing on 12 million homes?